child tax credit october 15 2021

Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Families will receive 3600 for each child under the age of 6 while receiving 3000 for each child between the ages of 6 and 17.

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

The IRS is paying 3600 total per child to parents of children up to five years of age.

. Child tax credit payments worth up to 300 will be deposited from October 15 Credit. That drops to 3000 for each child ages six through. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

Parents with dependents between the ages of 18 and 24 can also. For parents who received their first child tax credit payment in July the maximum monthly payment for each child 6 to 17 years old is 250 and 300 for each kid under age 6. Starting with the October payments the individuals who received those payments approximately 220 000 people will stop receiving payments.

The child tax credit scheme was expanded to 3600 from 2000 earlier this year. The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars depending on your personal situation. The phaseout range for the basic 2000 child tax credit for 2021 starts at a modified adjusted gross income of 400000 for married filing jointly and 200000 for other filers.

The IRS will send out the next round of. To qualify as a dependent this can be a child that is under age 19 or under 24 if they are a full-time student. Checks will be sent out from October 15 and should arrive in bank.

That drops to 3000 for each child ages six through. These changes will only apply for the 2021 tax year. CHild Tax Credit What payments are missing.

The first three payments were sent on July 15 August 13 and September 15 while the fourth payment was sent on October 15. The first checks were distributed automatically by direct deposit beginning on July 15 to those who filed income tax returns in. There are tax deductions for those that have dependents living full-time in their household the most common of which is the Child Tax Credit and Child and Dependent Care Credit.

15102021 - 1106. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or. For qualifying children claimed on multiple returns the eligible individual will receive any remaining Child Tax Credit when they file their 2021 return next year.

As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of 3600 per child under 6 and 3000 per child up to age 17. The Internal Revenue Service will send out the next payment of the 2021 Child Tax Credit to millions of families across the United States on Friday Oct. The credit is being issued in installments of up to 300 per month.

To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Three payments of the credit have already been sent out and three more are to come in 2021 with the next one due on October 15. The next child tax credit payment will be issued on October 15 2021.

Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose. It is worth remembering that you will receive. Ts the time of the month where millions of parents of children across the United States will be receiving their fourth.

The IRS is paying 3600 total per child to parents of children up to five years of age. Before this year the refundable portion of the CTC was limited to 1400 per child. They could also get up to 250 per qualifying child between 6 and 17 years or a total of 3000.

The CTC in 2021 is a fully refundable tax credit meaning that eligible families can receive it even if they owe no federal income tax. According to the IRS the latest batch of payments totaled about Child. Most households will receive up to a stimulus check worth up to 300 per child in the coming days.

Enter Payment Info Here tool or. AMERICANS with children will receive their next stimulus check on October 15 as part of the 2021 child tax credit. The credit was implemented in July by President Joe Biden who included it in the 19trillion American Rescue Plan.

The American Rescue Plan has expanded the CTC for the 2021 tax year.

Canadian Tax News And Covid 19 Updates Archive

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Child Tax Credit 2021 8 Things You Need To Know District Capital

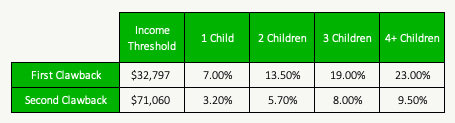

Climate Action Incentive Payments Caip For 2022 How Much Will You Get Savvynewcanadians

Some Parents Won T Get Child Tax Credit Payments Unless They Sign Up By Oct 15 Here S Why Cnet

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

The Advance Child Tax Credit 2022 And Beyond

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion Bfi

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

2022 Public Service Pay Calendar Canada Ca

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

Some Parents Won T Get Child Tax Credit Payments Unless They Sign Up By Oct 15 Here S Why Cnet

Child Tax Credit 2021 8 Things You Need To Know District Capital

How Does The 2021 Child Tax Credit Affect Your Income Taxes Goodrx

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy