philadelphia transfer tax exemption

Common transactions that are excluded from real. Philadelphia transfer tax law excludes 28 transactions while Pennsylvania transfer tax law excludes 34 transactions.

Pennsylvania Estate Tax Everything You Need To Know Smartasset

A divorced couple.

. Philadelphias revenue department is currently updating materials associated with the citys real-estate transfer tax to raise awareness about a 2007 ruling that expanded the. Husband and wife. When you complete a sale or transfer of real estate that is located in Philadelphia you must file and pay the Realty Transfer Tax.

In 2020 youll see that the land is valued at 30315 and the improvements at 171785. Succession laws is exempt from tax. Additionally a transfer to or from a nonprofit housing corporation that has been incorporated by officials of Philadelphia for the purpose of promoting the development of low cost housing in.

The Homestead Exemption reduces the taxable portion of your propertys assessed value. One of the most popular transfer tax exemptions is the intra-family exemption. Provide the name of the decedent and estate fi le number in the space provided.

The tax becomes payable when a property deed or other document showing realty ownership is. Philadelphia Code 19-1405 6 exempts transfers between. Deeds to burial sites certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt from the tax.

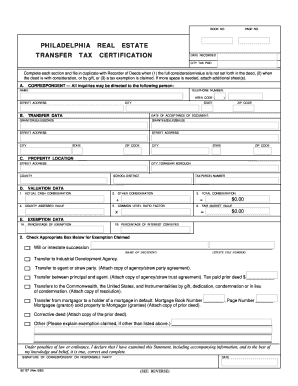

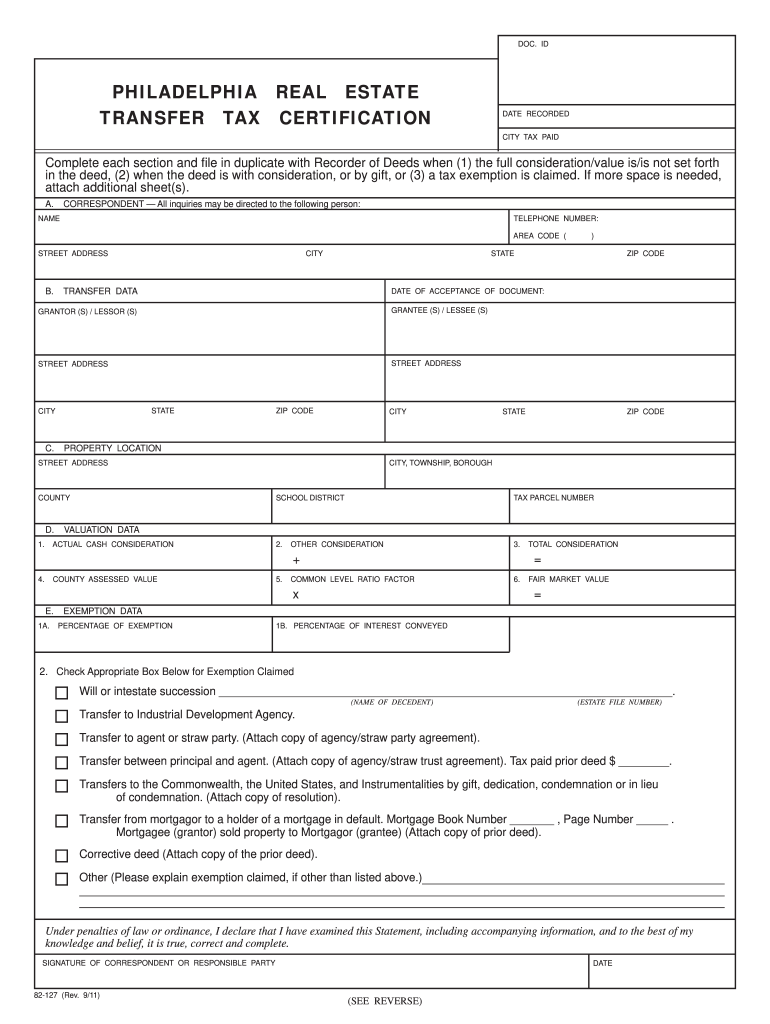

The following transfers are excluded from the tax. Transfer To or From Agent or Straw Party - A transfer to or from an agent. These documents contain the full regulations for the Realty Transfer.

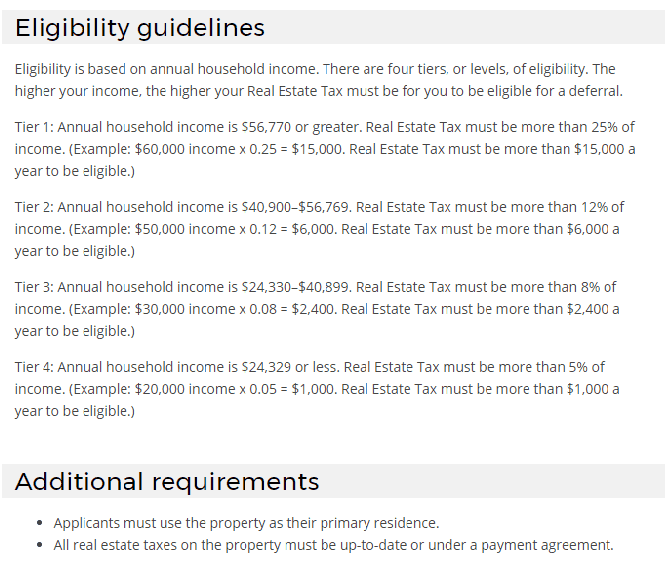

The City of Philadelphia offers a number of abatement and exemption programs that may reduce a propertys real estate tax bill. Philadelphia transfer tax exemption Thursday February 24 2022 Edit. Real Estate Transfer Tax certificates.

Tax abatements reduce taxes by applying credits to the amount. Pennsylvania Code section 91193 b 6 is all about transferring property to family members and is by far the most common exemption a real estate attorney like myself comes. The Philadelphia Realty Transfer Tax was imposed by Ordinance of City Council approved 1952 codified as Chapter 19-1400 amended by Bill No.

Guide To Philadelphia Real Estate Transfer Tax Exemptions Rabinovich Sokolov Law Group Llc 2011. The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200 percent Philadelphia County sales tax. With this exemption the propertys assessed value is reduced by 80000.

Transfer to or from the agents principal by the third party would be exempt from tax. Attach a copy of the agencystraw party agreement and a statement explaining the exemption claimed. Philadelphia PA 19107.

567 approved June 5. Philadelphia Transfer Tax Exemption. When we say exemption what we mean is there are certain times when recording the transfer of a property from one party to another does NOT trigger the need to pay either the.

The City of Philadelphia imposes a Realty Transfer Tax on the sale or transfer of real property located in Philadelphia. You dont have to pay the Realty Transfer Tax if the transfer of home ownership is between family members such as spouses siblings. The Realty Transfer Tax applies to the sale or transfer of real estate located in Philadelphia.

City Releases Property Tax Calculator To Assist Homeowners Department Of Revenue City Of Philadelphia

Sales Taxes In The United States Wikipedia

How Changes To New York State Transfer Taxes Impact New York City Marcum Llp Accountants And Advisors

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp

18 Printable Deed Of Gift Real Estate Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Philadelphia Department Of Revenue Facebook

Philadelphia County Gift Deed Form Pennsylvania Deeds Com

Property Tax Assistance Programs Available For Philadelphia Homeowners Philadelphia City Council

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Pgn 1 09 09 Edition By The Philadelphia Gay News Issuu

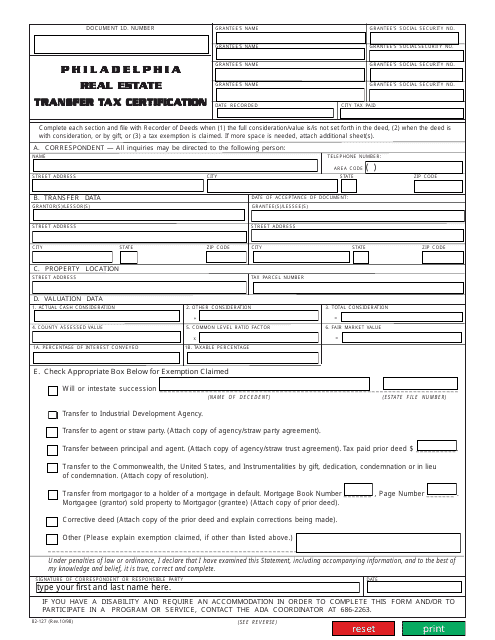

Pa 82 127 Philadelphia 2011 2022 Fill Out Tax Template Online Us Legal Forms

Philadelphia Real Estate Transfer Tax Certification City Of Philadelphia Phila Fill Out Sign Online Dochub

Economy League Philadelphia Budget Analysis

Estate Tax Planning Philadelphia Estate Tax Planning Attorney

Form 82 127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

Pennsylvania Quitclaim Deed Form Legal Templates

Philadelphia Real Estate Transfer Tax Philadelphia Real Estate Transfer Tax Pdf Pdf4pro

Estate Tax Exemption Will Fall Now Is The Time To Plan Rea Cpa